A simple package to get the EIOPA rates directly in your script.

The data is accessed through an API which is regularly updated with the latest EIOPA rates.

Note:

You can install the released version of eiopaR from CRAN with:

install.packages("eiopaR")You can install the development version from GitHub with:

# install.packages("devtools")

devtools::install_github("MehdiChelh/eiopaR")Note: If you use Excel, you can also use the add-in

EIOPA_API.xlam

of this repository (in the Excel ribbon:

Developer > Add-ins > Browse > EIOPA_API.xlam). It

imports a formula called EIOPA that can be used in Excel as

follows: EIOPA("with_va", "FR", 2019, 12) or also

EIOPA("no_va", "FR", 2019, 12).

The following script gives you the risk-free rates with volatility adjustment:

library(eiopaR)

rfr <- get_rfr_with_va(region = "FR", year = 2017:2018, month = 12)

rfr

#> <eiopa_rfr>

#> 20171231_rfr_spot_with_va_FR > -0.00318, -0.0021, -0.00048 ...

#> 20181231_rfr_spot_with_va_FR > -0.00093, -0.00035, 0.00063 ...Note: It is recommended to limit the number

of calls to the functions get_rfr,

get_rfr_with_va, get_rfr_no_va and to store

the results of your calls in the environment variables of your session

(like in the example above rfr <- get_...). Your IP can

be temporary or permanently blocked if too many queries are

executed.

The rates are then accessible as a data.frame:

head(rfr$data)

#> 20171231_rfr_spot_with_va_FR 20181231_rfr_spot_with_va_FR

#> 1 -0.00318 -0.00093

#> 2 -0.00210 -0.00035

#> 3 -0.00048 0.00063

#> 4 0.00109 0.00194

#> 5 0.00249 0.00339

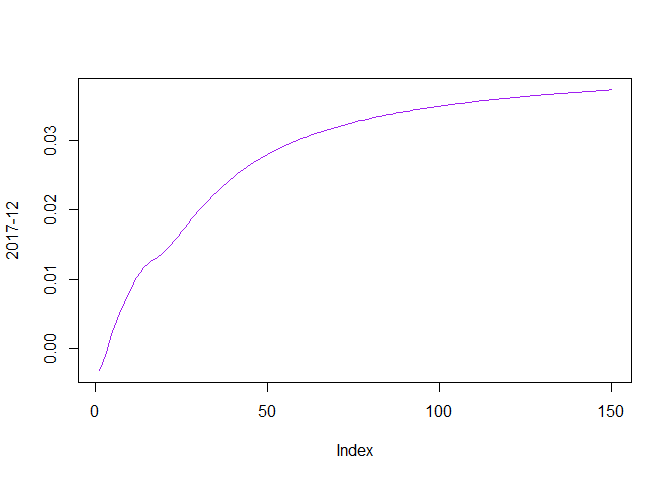

#> 6 0.00387 0.00478plot(

rfr$data$`20171231_rfr_spot_with_va_FR`,

ylab = "2017-12",

type = 'l',

col = "purple"

)

Pull requests are welcome. For major changes, please open an issue first to discuss what you would like to change.

Please make sure to update tests as appropriate.

See EIOPA | Risk-free interest rate term structures for more information.